PBOC Drafts New Payment Service Rules for Public Review

PBOC Drafts New Payment Service Rules for Public Review

On April 22, 2024, the People’s Bank of China (“PBOC") published on its website the draft version of the Implementation Rules for the Regulation on Supervision and Administration of Non-bank Payment Institutions (《非银行支付机构监督管理条例实施细则征求意见稿》) (“Draft Rules") to solicit public comments. The Draft Rules is the first implementation rules for the Regulation on Supervision and Administration of Non-bank Payment Institutions (《非银行支付机构监督管理条例》) (“New Regulation") which came into effect on May 1, 2024. This article aims to provide an overview of the key changes introduced by the Draft Rules.

1. Business Types

According to the New Regulation, China-based payment services providers (“PSPs") and all foreign PSPs that provide cross-border payment services to Chinese users are required to obtain Payment Services Permits (支付业务许可证) issued by PBOC. Under the legal framework prior to the implementation of the New Regulation, a Payment Services Permit may cover one or more of the following business types:

* Internet Payment (互联网支付);

* Mobile Phone Payment (移动电话支付);

* Prepaid Card Issuance and Acceptance (预付卡发行与受理) or Prepaid Card Acceptance (预付卡受理);

* Bankcard Acquiring Business (银行卡收单); and

* Digital TV Payment (数字电视支付).

Due to the rapid technology developments which have revolutionized people’s way of life, the categorization system above has grown increasingly inadequate in accurately classifying contemporary payment services. The New Regulation therefore introduced a simplified categorization for issuing the Payment Services Permits, featuring only two categories, namely, Stored Value Account Operation (储值账户运营) and Payment Processing Operation (支付交易处理).

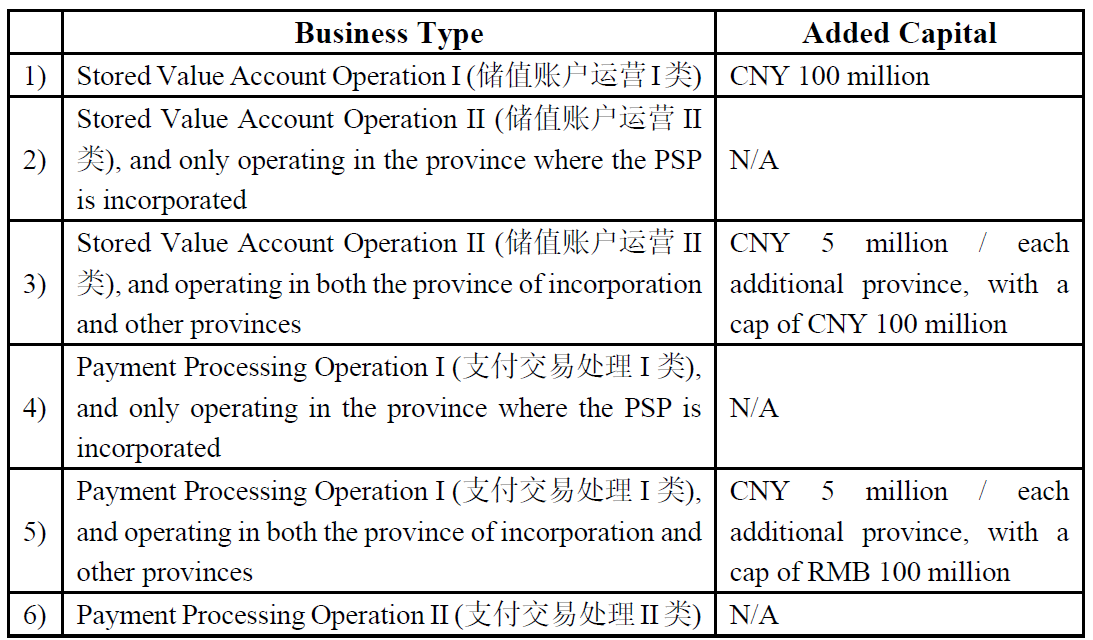

Article 57 of the Draft Rules outlines how the existing business types may be aligned with the New Regulation’s categorization, as shown below:

2. Registered Capital

Prior to the implementation of the New Regulation, PSPs were generally subject to a uniform CNY 100 million minimum registered capital requirement, regardless of their different scopes of business. In the New Regulation, however, PBOC is given the leeway to impose different thresholds of registered capital to fit different business types. The Draft Rules now takes a step further and proposes to clarify the calculation method for such capital thresholds, as summarized below:

Minimum Registered Capital = Base Registered Capital + Added Capital

Where the Base Registered Capital is CNY 100 million, and the Added Capital is calculated as below:

It should be noted that if a PSP fits descriptions in categories 1), 3), and/or 5) above, then its applicable Added Capital should be the sum of the amounts specified in all applicable categories.

3. Net Asset to Customer Reserve Fund Balance Ratio

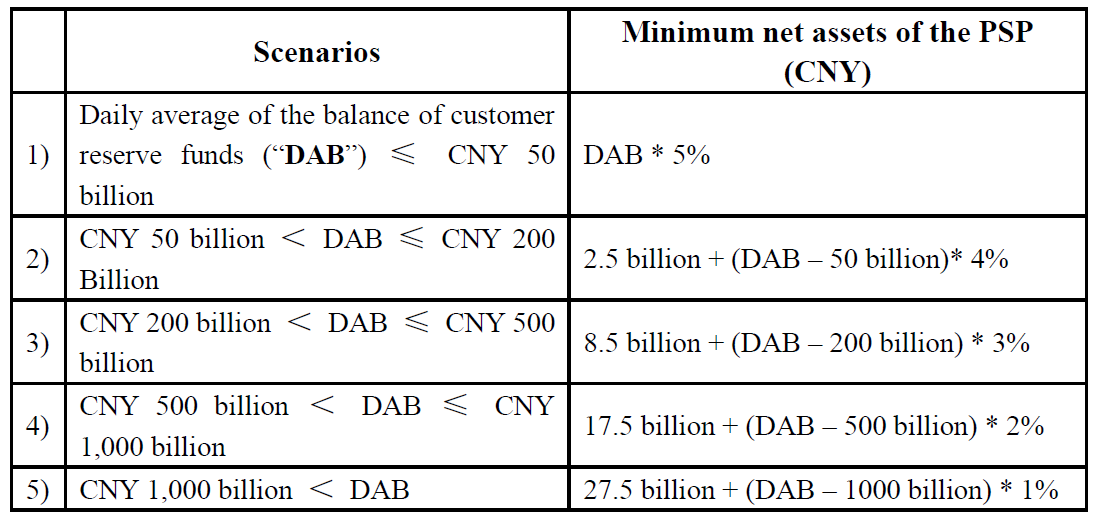

The New Regulation also introduces a new principle that PSPs should have sufficient net assets to operate. Article 61 of the Draft Rules proposes that the minimum net assets of the PSP should satisfy certain thresholds calculated based on the daily average of the balance of customer reserve funds:

According to Article 78 of the Draft Rules, DAB shall be calculated as the mean of the customer reserve fund balances recorded at the end of each day throughout the most recent calendar year (January 1 to December 31).

4. Transitional Period for Existing PSPs

For PSPs licensed to operate before the effective date of the New Regulation, there could be a risk if they do not currently meet the minimum registered capital requirements and minimum net assets requirements proposed in the Draft Rules. According to Article 76 of the Draft Rules, existing PSPs shall have until the expiry of their current payment business license (i.e., until the next license renewal) to meet the qualification requirements and net asset to customer reserve fund balance ratio requirements (as discussed above). For a PSP whose license will expire within 12 months, the transitional period will be extended to 12 months.

5. Missing Clarity for Foreign-based PSPs

The New Regulation has drawn a lot of attention from foreign-based PSPs largely due to the requirements under the second paragraph of Article 2, which requires any non-bank institution outside China that intends to provide cross-border payment services to domestic users to establish a non-bank payment institution in China.

In current practice, many foreign-based PSPs provide cross-border payment services and foreign exchange settlement to their PRC customers through their Chinese partners who possess a payment services license and qualification to process cross-border RMB/foreign currency transactions. While both the foreign-based PSPs and their local partners are eagerly waiting for the other shoe to drop - if their business model can continue, or the foreign-based PSPs must conduct business via a Chinese PSP in its own name, both the New Regulation and the Draft Rules are still silent on this issue.

6. Concluding Remarks

The Draft Rules has provided much-needed clarification on certain issues regarding the transition from the existing legal framework to the New Regulation, such as the categorization of business types, registered capital, net assets, and the transitional period.

On the other hand, the Draft Rules remains silent on certain vague areas under the New Regulation, such as the definition of the cross-border payment services provided by foreign non-bank payment institutions. Please note that the Draft Rules is still in public consultation phase. As such, it is important to recognize that the final versions of the implementation rules may be different from the current draft. We will closely monitor further legislative actions.