Zhong Lun Advises on Fangzhou’s IPO in Hong Kong

Zhong Lun Advises on Fangzhou’s IPO in Hong Kong

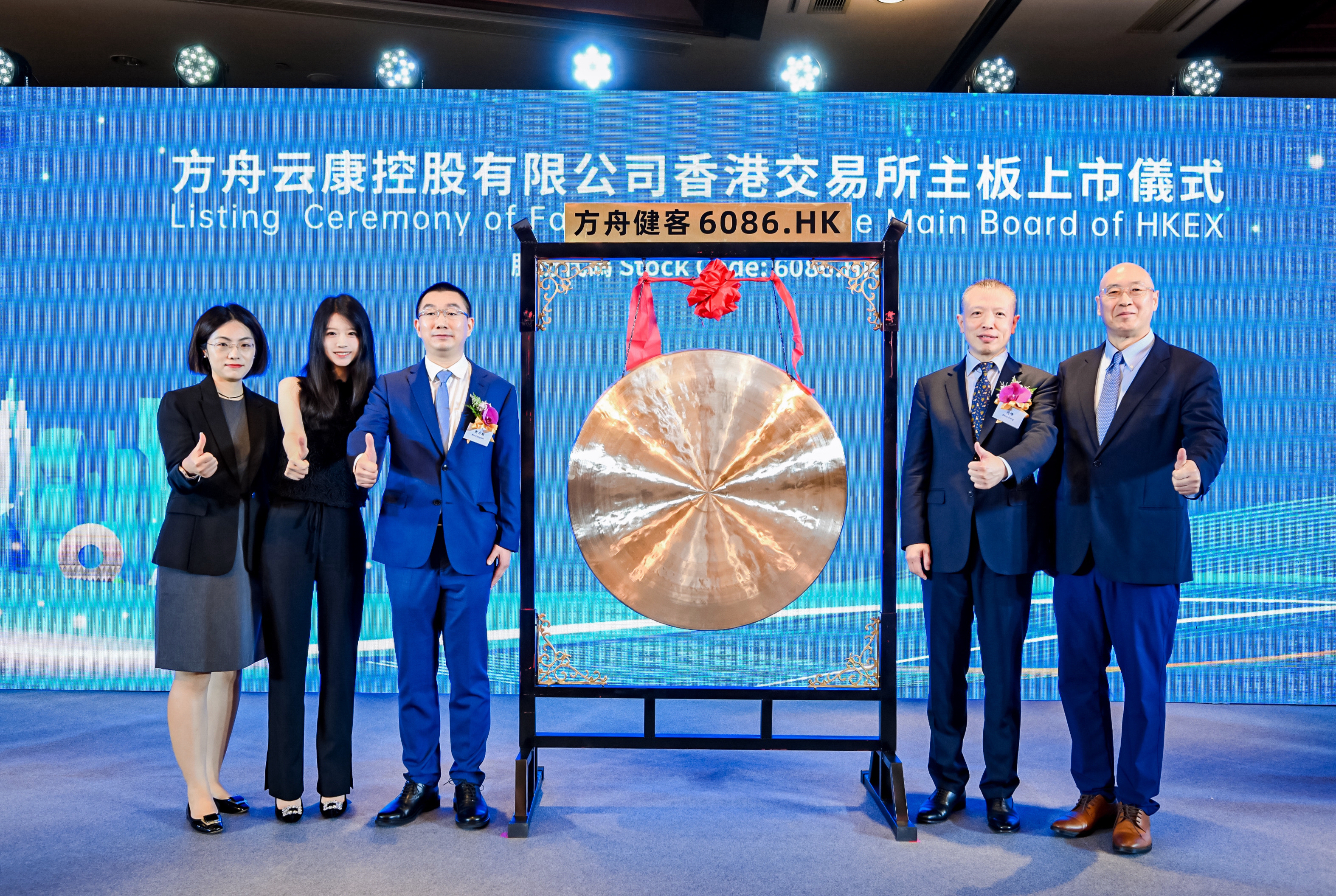

On July 9, 2024, Fangzhou Inc. (6086.HK) announced the closing of its initial public offering and listing on the Main Board of The Stock Exchange of Hong Kong Limited. Citi Group and ABCI acted as the joint sponsors for the offering. It is one of the few overseas listings with a VIE structure that have completed the CSRC filing and the first one in the Internet healthcare sector.

Fangzhou has commenced business with a focus on chronic disease management to address the needs of patients with chronic diseases, such as hypertension, cardiovascular and respiratory chronic diseases. It has provided comprehensive medical services and online retail pharmacy services through Jianke Platform. Fangzhou is the largest online chronic disease management platform in China in terms of average MAU in 2023, according to CIC.

Zhong Lun Law Firm has provided long-term legal services to Fangzhou and acted as the issuer’s PRC legal advisor in this offering. The project team was led by partners Anthony Zhao and William Jia, and included associates Crystal Li, Claire Yang, and Stella Zhou. Senior counsel Paul Wang was in charge of the related private equity financing. In addition, for this offering, partner Jihong Chen and non-equity partner Jian Chen advised on the relevant data compliance matters, and partner Mark Gao advised on the relevant tax and trust matters. Partners Lijun Cao and Laura Chen advised on the relevant dispute resolution matters. This project has fully reflected Zhong Lun’s advantage of “in-depth expertise divisions and close inter-department collaborations”.