First-Store Economy丨Brand Legal Report-Domestic Chapter

First-Store Economy丨Brand Legal Report-Domestic Chapter

1. New Consumption Opportunities

1.1 Significance of First-Store Economy

The Ministry of Commerce of the People’s Republic of China released the "Guidelines for the Evaluation of First-Store Economy (Draft for Comments)"[1]on August 23, 2024. It defines "First Stores" as the first physical stores opened by a brand in a specific administrative region, which have a commercial agglomeration effect and radiating capacity. These stores are also referred to as brand first stores. Additionally, first stores can be flagship or concept stores that significantly differ from the brand’s standard stores in terms of products and services due to upgrades, renovations, or innovative integrations.The "First-store Economy" refers to the economic activities of attracting brands to open their first stores in a region by leveraging local resource advantages. The continuous operation of these first stores in the region positively impacts urban vitality and is an important part of the "First-launch Economy"[2]. In 2015, Shanghai first proposed to seize the opportunities of the first-store economy[3], attracting domestic and international brands to open their first stores in the city to create globally influential landmarks and promote high-quality regional economic development. Since then, several other cities, including Beijing, Shenzhen, Guangzhou, and Chengdu, have also introduced policies to support the development of the first-store economy[4].

1.1.1 Policy Incentives

Under the impetus of domestic first-store policies, China continues to drive local economic development through a three-pronged approach, with a particular emphasis on stimulating the first-store economy to boost domestic demand, seeking new consumption opportunities, and developing the new consumption economy—namely, the first-store economy. On January 13, 2025, the General Office of the State Council issued the"Notice on Several Measures for Further Cultivating New Growth Points and Flourishing Cultural and Tourism Consumption"(Circular No. 2 [2025] of the General Office of the State Council)[5] . Additionally, on August 3, 2024, the State Council released the "Opinions on Promoting High-Quality Development of Service Consumption" (Circular No. 18 [2024] of the State Council) [6], and on June 24, 2024, the National Development and Reform Commission of the People’s Republic of China issued the "Notice on Several Measures for Creating New Consumption Scenarios and Cultivating New Growth Points"(Circular No. 840 [2024] of the NDRC)[7]. These documents underscore the importance of further cultivating and strengthening new consumption growth points. The state is actively promoting the continuous emergence of new consumption forms, models, and products, thereby stimulating market vitality and corporate potential, and fostering new consumption scenarios in catering, cultural tourism, sports, and shopping. This approach aims to drive sustainable development of China’s consumption-led economy. Under the dual impetus of policy incentives and market forces, domestic and international brand first stores have successively landed in major cities such as Beijing, Shanghai, Hangzhou, and Wuhan, with a concentration in core shopping centers like Beijing Taikoo Li, Shanghai IAPM, and Hangzhou Place.

1.1.2 Revenue Generation

The development of first-store economies can enhance local government’s fiscal and tax revenues. For example, in 2023, the first-store economy in Jing'an District led to a total retail sales of consumer goods reaching 170.789 billion RMB, representing a 15.3% year-on-year increase, while the total sales of goods amounted to 1.1 trillion RMB, a 5.4% increase[8].From a market perspective, it can meet diverse consumer demands and generate revenue for both brands and commercial districts. For instance, Joy City in Beijing Haidian, which opened on December 21, 2024, introduced over 200 brands, with opening-day sales exceeding 17.77 million RMB[9]. For both domestic and international brands, policies promoting the first-store economy can not only secure financial support from local governments but also leverage the first-store effect to attract potential customers, thereby increasing business revenue. The development of the first-store economy satisfies the diverse needs of consumers, stimulates urban employment and commercial prosperity, drives consumption upgrades, and facilitates economic transformation, ultimately contributing to the growth of enterprise revenues.

1.1.3 Brand Enhancement

The development of the first-store economy is conducive to brand enhancement and the improvement of brand commercial value. With the evolution of the market and the continuous upgrading of consumer demands, the first-store economy has gradually expanded into the concept of the "debut economy", which is more comprehensive and has a broader scope. The debut economy refers to a series of economic activities that involve the launch of new products, new business formats, new models, new services, new technologies, and the establishment of first stores, among others. It encompasses the entire chain of development, from the first release or exhibition of products and services to the opening of the first store, the establishment of research and development centers, and even the setting up of company headquarters[10]. The scope of the debut economy is not limited to the "opening of first stores" or "first product launches", but also includes the "Debut economic ecosystem from new products to first stores and headquarters" and features "influential international brands and leading domestic brands"[11].

1.2 The Current Status and Significance of Domestic First Stores

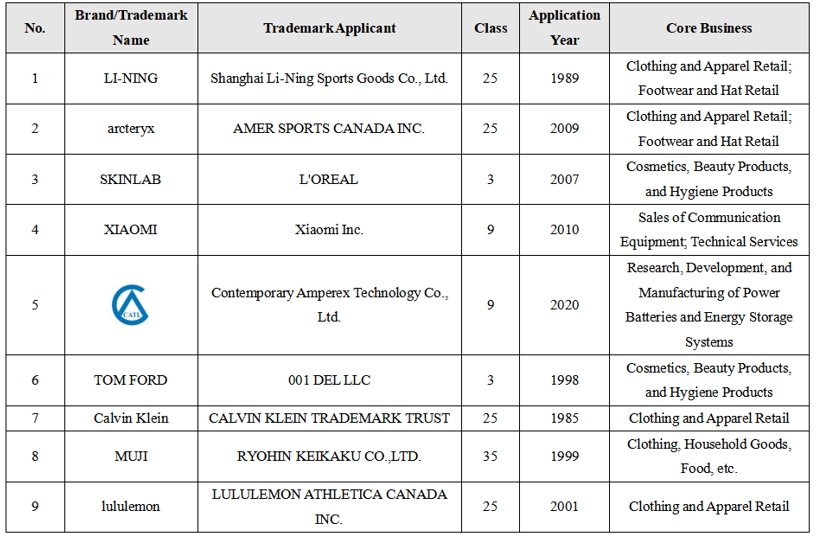

1.2.1 Trademark Application and Registration

Before the establishment of a domestic first store for domestic brands or a first store for international brands in China, companies must conduct a self-assessment of their trademark application strategy with the China National Intellectual Property Administration (CNIPA). At the same time, a trademark search and intellectual property due diligence should be carried out to identify any gaps or missing protections. Companies should actively secure core trademarks, apply for defensive trademarks, and prevent the risk of their trademarks being hijacked or falling into trademark infringement disputes. Below is the trademark application and registration status of some well-known brands expanding their first stores (including both international and domestic brands) for reference by companies planning their first-store strategies.

(Data Source: China National Intellectual Property Administration (CNIPA))

1.2.2 Brand Licensing Authorization

According to the latest report titled 2024 Top Global Brand Licensing Agents Report published by the magazine LICENSE GLOBAL[12], global licensing agents experienced a sales increase of $5.7 billion in 2023, with a total retail sales volume of $93.63 billion for the year. Among these licensing agents, the top 10 companies generated a total retail sales of $69.6 billion, while the top 20 companies' retail sales exceeded $85.24 billion. These agents include globally renowned organizations such as IMG, CAA, Beanstalk, LMCA, Brand Central, and others.

In recent years, the brand licensing authorization situation for domestic first stores in China has seen rapid development. According to the 2024-2030 China Brand Licensing Industry Market Competition Status and Development Trend Report, in 2023, there were 654 brand licensing companies in China, with retail sales of licensed brand products reaching 140.1 billion RMB, and licensing fees for brand licensors totaling 248.3 billion RMB. From January to October 2023, more than 80 foreign brands entered China to open their first stores, with retail formats being the dominant sector, accounting for 77% (65 brands). Shanghai demonstrated strong market attraction, with 52 foreign brands establishing their first stores in the city. The report's first-store entry distribution map shows that the brand licensing industry in China is mainly concentrated in Beijing, Shanghai, Zhejiang, and Guangdong. For example, Shanghai Bailian ZX Mall, which officially opened in 2023, has continuously introduced several domestic emerging ACGN art toy retail first stores and has also attracted numerous well-known Japanese content production companies to establish their first stores in China.

1.2.3 Brand Dispute

Against the backdrop of the rapid development of global and domestic first stores, brand disputes, especially issues related to trademark hijacking and infringement, have persisted. These disputes not only affect a brand's market reputation but can also lead to legal litigation and economic losses. Brand owners need to strengthen intellectual property protection, promptly identify and address infringement activities, and take necessary measures to safeguard their legal rights.

1.2.3.1 Trademark Hijacking Disputes

When international brands enter China to establish their first stores, they must carefully assess the risk of trademark hijacking. Due to the territorial nature of trademarks, companies should conduct a trademark search before entering the market to confirm whether any prior hijacking has occurred. For example, in the trademark hijacking dispute between Ralph Lauren and a leather goods company[13], Ralph Lauren discovered in 2011, after launching its comprehensive direct sales strategy, that numerous Chinese domestic retailers were using the "Polo Sport" and "Polo Golf" trademarks to produce apparel and open stores. In 2016, Ralph Lauren initiated a series of civil infringement lawsuits, but due to the fact that some of the infringing trademarks had been granted registration for over five years, it was not easy to remove them through opposition or invalidation procedures. In 2021, Ralph Lauren's legal team made progress through both administrative and civil litigation. The Beijing High People's Court made a second-instance administrative ruling, declaring that the "Polo Sport" series trademark used by the defendant should be invalid.

1.2.3.2 Trademark Infringement Disputes

Trademark infringement is one of the common challenges faced by international brands when entering the Chinese market. For example, in the Lafite trademark infringement punitive damages case[14], the plaintiff holds the trademark rights to “LAFITE” and other related trademarks, which are registered for alcoholic beverages. This trademark, having been in use for an extended period, has gained significant recognition and established a strong association with the name “拉菲” (means LAFITE). In 2005, the defendant, a Nanjing wine company, registered the trademark “拉菲庄园” (means LAFEI MANOR), and subsequently began using it, along with six other defendants, under various marks such as “拉菲庄园”(means LAFEI MANOR) and “LAFEI MANOR”. After the "拉菲庄园"(means LAFEI MANOR) trademark was declared invalid, the plaintiff filed an infringement lawsuit against the seven defendants. The court determined that the defendants' registration and use of the “拉菲庄园” (means LAFEI MANOR) trademark constituted malicious attachment to the plaintiff's “LAFITE” trademark and was a serious case of trademark infringement. As a result, the court ruled for punitive damages, ordering the defendants to pay 79.17 million RMB in damages and reasonable expenses.

1.2.3.3 Customs Enforcement and Trade Investigation

In customs enforcement, it is common to find individuals or companies attempting to import goods that use others' registered trademarks without authorization, leading to customs seizures or trade investigations. When products are suspected of infringing intellectual property rights, such as trademarks, patents, or copyrights, U.S. Customs and Border Protection (CBP) has the authority to seize goods and conduct investigations. Trademark protection covers counterfeit goods, goods with confusingly similar marks, and parallel imports; copyright protection includes obvious counterfeit goods and those that may be pirated; patent protection is enforced through exclusion orders issued by the International Trade Commission (ITC).

For example, customs authorities may seize goods such as clothing, cosmetics, and other products that unlawfully bear well-known brand trademarks. These infringing products are seized in accordance with the law, and penalties are imposed on the responsible parties to protect the brand owner's rights. Additionally, the target country may initiate trade investigations and impose trade sanctions, such as increased tariffs or import restrictions.

In the case of the U.S., for instance, the country may conduct a "Section 337 investigation" or "Section 301 investigation" on products suspected of infringement. Through exclusion orders or other sanctions, the U.S. can penalize the involved infringing parties.

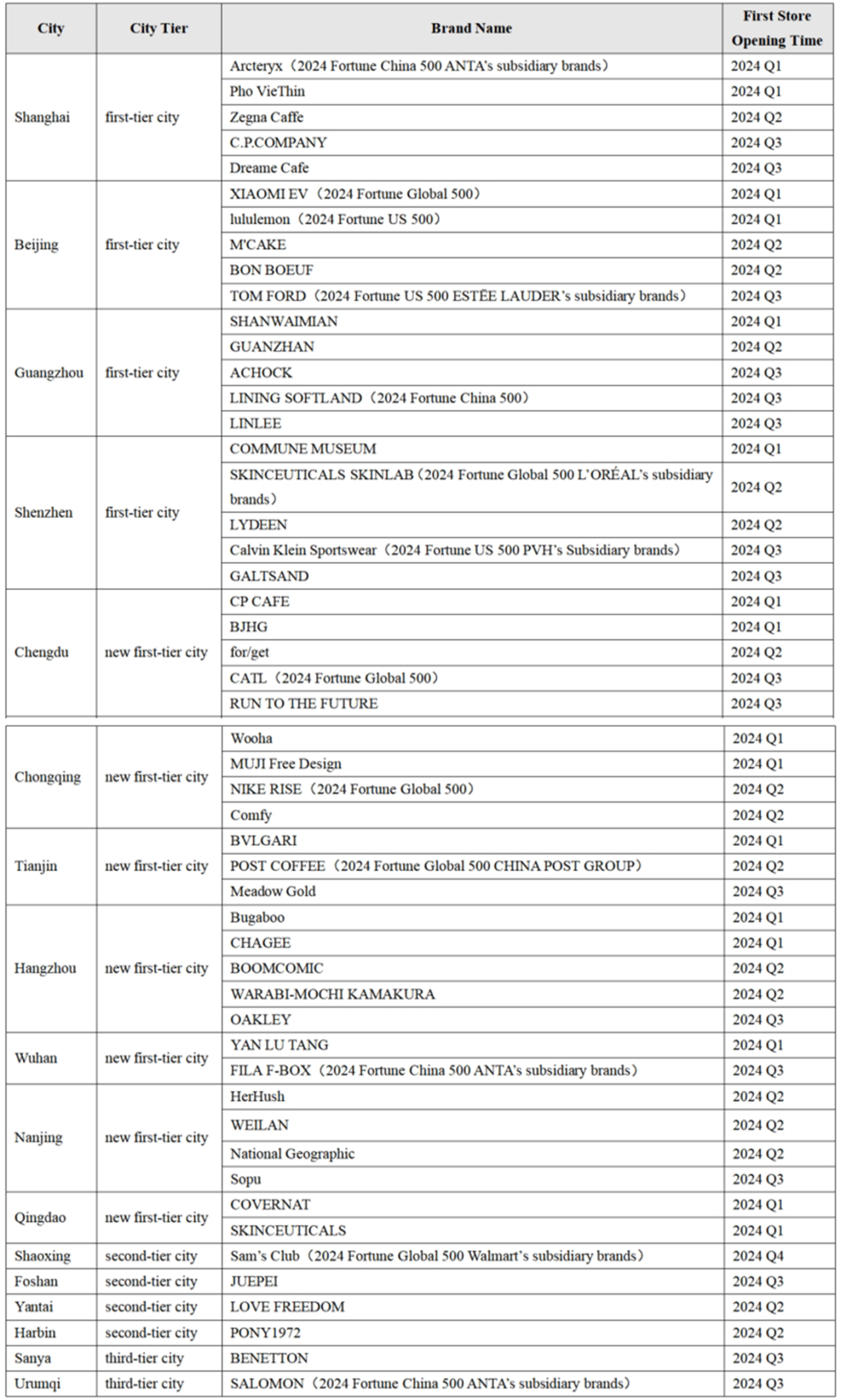

1.2.4 Domestic First Store Distribution

Regarding the distribution of domestic first stores, the following is a snapshot of some key first-store entries in major cities across China in 2024:

From the first to the third quarter of 2024, the first-store economy sustained significant momentum across major cities in China. Various types of first stores continued to open nationwide, reflecting the sector’s robust development trajectory throughout the year. First-tier cities, including Beijing, Shanghai, Shenzhen, and Guangzhou, remained key hubs for first-store openings. These cities’ large consumer markets, advanced commercial infrastructure, convenient transportation networks, and international business environments have solidified their status as preferred locations for brands to debut their flagship stores. Meanwhile, new first-tier cities such as Hangzhou, Chengdu, Nanjing, Wuhan, and Chongqing also saw a notable number of first-store openings across each quarter. The consistent presence of these openings underscores the progress these cities have made in consumption upgrading and commercial development. As a result, they have increasingly become important frontiers for brands seeking to expand their market reach.

2. Location of First Store in China

The location for a brand's domestic first store constitutes a critical strategic priority. As evidenced by current national policies, Tier 1 cities including Beijing, Shanghai, and Guangzhou demonstrate well-structured incentive mechanisms for first-store establishments. Enterprises with sufficient capital reserves and established brand recognition are advised to prioritize market entry through these metropolitan hubs. Below is a comparative overview of first-store incentive policies across major Chinese cities (2021-2023).

China’s first-tier cities (Shanghai, Beijing, Guangzhou, Shenzhen) have pioneered "first store economy" policies with distinct first-mover advantages. For example, Shanghai, as a hub for global brand debuts, first exhibitions, and first store openings, boasts a comprehensive policy framework and robust financial incentives. In 2024, it offers up to 1.2 million RMB in subsidies for high-level first stores and 1.2 million RMB for debut events, while streamlining approvals, enhancing customs clearance, and building a professional service ecosystem to propel high-quality "debut economy" growth. Beijing prioritizes attracting Asian first stores with grants of up to 5 million RMB, positioning itself as a global debut hub through service systems and debut festivals. Guangzhou’s 2024 policies include a platform for store location selection, 3 million RMB incentives for eligible brands, and improvements in government services and policy implementation. Shenzhen focuses on strengthening both "first store" and "debut" economies, encouraging fashion-industry integration and leveraging e-commerce to expand new product markets.

New first-tier cities (Hangzhou, Chengdu, Chongqing, etc.) are actively following. Hangzhou 2025 plan aims to build an international shopping paradise via debut economy initiatives. Chengdu is aggressively attracting high-tier first stores to its commercial hubs while driving cross-regional business integration under the Chengdu-Chongqing economic circle framework. Chongqing incentivizes first store and debut activities with multifaceted rewards, cultivates special brands, and optimizes its business environment. These cities are crafting differentiated strategies to compete with first-tier peers.

Second-tier and third-tier city (Shaoxing, Sanya, Harbin, etc.) are also making strides. Shaoxing offers tiered incentives for flagship store openings and supports event marketing. Sanya is building a "four-firsts" economy, funding for renowned brands to open first store, hold debut events and other activities. Harbin gives rewards in different amounts according to the popularity of the introduced brands, so as to stimulate the enthusiasm of debut economy construction. These cities’ policies place more emphasis on leveraging the first store economy to activate the local consumer market and enhance the city's commercial popularity and influence. The intensity of these policies is well-aligned with the city's economic scale and development orientation.

3. How to Open the First Store

3.1 Company Structure

Prior to the establishment of the first store domestically, it is imperative to ascertain the details pertaining to the company's equity structure, organizational form, and scope of business, particularly in cases where overseas brands are entering the Chinese market to launch their inaugural store. For overseas brands, emphasis should be placed on researching the optimal form of company establishment (such as limited liability or partnership) and the mode of capital contribution. Taking the entry of an overseas brand into China to open its first store as an example, the brand is required to initially determine the organizational form of the company (such as a wholly foreign-owned enterprise or a Sino-foreign joint venture), conduct thorough research on the most suitable equity structure, and promptly proceed with company registration.

3.2 Intellectual Property

With regard to intellectual property protection, the first store in China needs to conduct intellectual property due diligence in advance, to make early arrangements, and to carry out trademark registration, patent application, and copyright registration to prevent infringement risks and actively safeguard its own intellectual property rights.For example, the typical store signage can be protected as a design patent; the classic brand image can apply for copyright registration to enhance the publicity effect; while the core research and development technology and products of the store can be protected through invention patents or utility model patents; the store's technical formulas, process flows, business information, and management information can be protected through trade secrets. Among them, "trademark rights" are one of the most important intellectual property rights for domestic brand stores and also an important support for brand image building. Before opening the first store, the brand should combine the existing brand culture and the local market situation, and apply for trademark registration in a timely manner in the categories of goods or services corresponding to the core business and related businesses. Trademarks should include various forms such as word marks, graphic marks, composite marks, and three-dimensional marks to build a comprehensive trademark layout.

The selection of store spokespersons and the protection of their information are also important aspects of opening a first store. The use and protection of the spokesperson's portrait and name rights, as well as information protection, are involved. Companies need to ensure that they sign clear contracts with spokespersons, specifying the scope, duration, and fees for the use of portrait and name rights, and also need to clarify confidentiality clauses and liability for breach of contract in the contract to prevent unauthorized use and information leakage.

The protection of intellectual property rights for cartoon images is also an important issue for the establishment of first stores. The brand owners of first stores often have well-known cartoon images, and the protection of their intellectual property rights mainly involves copyright, trademark rights, and design patent rights. Cartoon images can be protected as artistic works under copyright law, their names and images can be registered as trademarks, and their designs can be patented. In judicial practice, the standard of “access + substantial similarity” is used to determine copyright infringement of cartoon images.

Brand collaborations are one of the directions for brand cooperation in the opening of first stores. The release of co-branded products involves the cooperation of multiple brands, with the core being the authorization of intellectual property rights. The intellectual property rights involved in co-branded cooperation mainly include copyright, patent rights, and trademark rights. In co-branded cooperation, both parties should clarify the authorization content, including the notation of logos, the explicit indication of the author's name and the work's title. In addition, the disclosure of trade secrets may be involved in co-branded cooperation, and both parties should sign a confidentiality agreement to ensure the security of information.

3.3 Compliance Requirements

When opening a first store in China, it is essential to pay attention to various compliance requirements, including tax compliance, government regulatory compliance, real estate leasing compliance, labor compliance, currency and financial compliance, advertising and marketing compliance(including the use of prohibited words in advertisements),franchise compliance (filing and related requirements), ESG(Environmental, Social, and Governance) compliance, and data compliance(including personal information security, network security requirements, legal regulatory requirements, and emergency response mechanisms). In cases where overseas brands are opening their first store in China, special attention needs to be paid to import and export compliance and cross-border data protection to ensure the normal opening and operation of the flagship store.

In China, commercial franchising refers to the business activity where an enterprise with registered trademarks, trade names, patents, proprietary technologies, or other business resources grants other operators the right to use its business resources through a contractual arrangement. The franchisee operates under a unified business model as stipulated in the contract and pays franchise fees to the franchisor. A franchisor engaging in franchising activities must possess a mature business model, the ability to continuously provide services to franchisees, and meet the "two stores and one year" requirement, which means having at least two directly operated stores with more than one year of operation. The franchisor is required to register with the relevant commerce authorities. Registration must be completed within 15 days from the date of the first franchise contract. When registering, the franchisor must prepare materials such as the business license, proof of business resources, and the franchise contract.

4. Conclusion

The first-store economy aligns with the development needs of brands both domestically and internationally. Companies can further consolidate their brand value through the advantage of being first to the market, while governments can boost the rapid development of domestic brand economies by incentivizing the first-store economy. Meanwhile, China is also committed to exploring the development gaps in overseas first-store economies to support brand globalization. For example, to encourage well-known traditional Chinese catering brands to expand overseas, the General Office of the State Council issued the "Opinions of the General Office of the State Council on Promoting the High-Quality Development of Service Trade through High-Level Opening Up" (State Council General Office Document No. 44 [2024]) on September 2, 2024[15], which states: "(12) Encourage the export of traditional advantageous services. Further improve policy measures to support the high-quality development of cultural trade. Promote the export of sports services such as Chinese martial arts and Go. Promote the healthy development of traditional Chinese medicine (TCM) service trade and actively develop 'Internet + TCM service trade'. Support well-known catering enterprises, including time-honored Chinese brands, in conducting international operations of Chinese cuisine brands to enhance the international influence of Chinese culinary culture. Actively use digital technology and artificial intelligence to innovate service supply and enhance the international competitiveness of the service industry." The development of the first-store economy represents a new opportunity for economic growth and a new chance for brand expansion.

[Note]

[1] Best Countries for Business _ U.S. News https://www.usnews.com/news/best-countries/rankings/open-for-business

[2] 2024 China Industry Globalization Development Research Report:https://www.36kr.com/p/2962516447186950

[3] The 2024 Report on Chinese Enterprises' Overseas Brand Marketing Strategies: https://www.vicsdf.com/doc/50ed2151ed345d89 (Accessed on January 15, 2025)

[4] The 2024 New Global Brand Insights Report: https://m.ebrun.com/567362.html (Accessed on January 10, 2025)

[5] The Ministry of Commerce of the People's Republic of China: Guidelines for Evaluating the First-Store Economy (Draft for Comments): https://scjss.mofcom.gov.cn/gztz/art/2024/art_dfbdc96ef5af47e0ab8ea216d128c26f.html (Accessed on January 15, 2025)

[6] https://www.ndrc.gov.cn/wsdwhfz/202408/t20240812_1392357.html (Accessed on January 10, 2025)

[7] The First-Day Economy May Become a New Growth Point in Consumption in 2025: https://stocknews.scol.com.cn/shtml/jrtzb/20250104/139839.shtml (Accessed on January 10, 2025)

[8] The General Office of the State Council: Several Measures for Further Cultivating New Growth Points and Promoting Cultural and Tourism Consumption: https://www.gov.cn/zhengce/zhengceku/202501/content_6998239.htm (Accessed on January 16, 2025)

[9] The State Council's Opinion on Promoting High-Quality Development of Service Consumption: https://www.gov.cn/zhengce/zhengceku/202408/content_6966275.htm (Accessed on January 16, 2025)

[10] The National Development and Reform Commission: Notice on Issuing Measures for Creating New Consumption Scenarios and Cultivating New Growth Points: https://www.ndrc.gov.cn/xxgk/zcfb/tz/202406/t20240624_1391289_ext.html (Accessed on January 16, 2025)

[11] Jing'an District: Strong Consumption Momentum, Total Retail Sales of Consumer Goods in 2023 Ranked First in the Central Urban Area: https://www.jingan.gov.cn/rmtzx/003008/003008004/20240118/0c83469d-5d95-417f-ab3a-00c39b499be9.html (Accessed on January 15, 2025)

[12] First-Day Sales Exceed 17.77 Million Yuan! Haidian Joy City's Activities Continue: https://mp.weixin.qq.com/s/aztSkMLoWJdtJybO2jTO7g (Accessed on January 15, 2025)

[13] http://theory.people.com.cn/n1/2024/0807/c40531-40294195.html (Accessed on January 10, 2025)

[14] https://www.ndrc.gov.cn/wsdwhfz/202408/t20240812_1392357.html (Accessed on January 10, 2025)

[15] https://www.licenseglobal.com/trends-insights/top-brand-licensing-agents-2024-brandscape (Accessed on January 16, 2025)