Employment Termination & Business Dissolution: Legal Pathways

Employment Termination & Business Dissolution: Legal Pathways

In recent years, global geopolitical realignments, economic volatility, and evolving Sino–U.S. trade relations have presented substantial challenges for companies operating in China. When facing corporate restructuring, financial distress, or strategic pivots, businesses may need to implement workforce reductions and eventually pursue market exit through voluntary liquidation. This article delineates the legal procedures and best practices for both employment contract termination and corporate dissolution procedures.

Terminating Employment Contract

According to Article 44 of the Labor Contract Law (in Chinese: 劳动合同法), employment contracts are automatically terminated upon the employer’s voluntary dissolution. This statutory provision entitles enterprises undergoing corporate dissolution to initiate termination procedures for all employment relationships. Meanwhile, Article 36 of the Labor Contract Law provides that employer and employee may negotiate contract termination through written consensus. In practice, this means an employer may unilaterally terminate all employment contracts upon dissolution of the company, subject to the payment of statutory severance.

In the event of termination due to company dissolution, severance payments shall be calculated based on the employee’s length of service, at the rate of one month’s wages for each full year worked.

In contrast, when employment is terminated by mutual agreement between employer and employee, there is no statutory minimum severance requirement. However, it is common practice to offer the statutory severance amount or slightly more - typically one to two months’ wages, but not exceeding double the statutory entitlement, to facilitate a smooth termination process.

An employee’s monthly wage shall include base salary and other monetary compensation such as bonuses, allowances and subsidies, but is capped at 3 times the local average monthly wages in the company’s city of registration.

Our experience is that seeking mutual termination agreements with employees is advisable wherever possible to streamline the process and mitigate potential disputes. Employees who decline mutual termination may eventually face termination under Article 44 of the Labor Contract Law, triggered by the enterprise’s voluntary dissolution.

To ensure a seamless termination process, professional legal practitioners are usually retained to handle the following matters:

1) Developing the termination and compensation plan;

2) Drafting,finalizing and executing all required legal documentation (including notice of termination, termination agreements, etc.);

3) Facilitating communication with employees regarding termination plans and compensation amounts;

4) Liasing with relevant labor authorities as needed; and

5) Providing on-site support to implement employment terminations when necessary.

Negotiating with employees can be particularly challenging. Skilled legal professionals are instrumental in these negotiations, clearly explaning labor matter procedures and protecting employee rights. Furthermore, they design compensation packages that effectively address the employees’ concerns, thereby facilitating smoother negotiations and minimizing dispute risks.

Corporate Dissolution through Voluntary Liquidation

Voluntary liquidation under the Company Law requires dissolution initiated through shareholders’ special resolution with 2/3 majority approval, distinct from insolvency-driven procedures. Legal practitioners are usually engaged to:

1) Prepare and execute requisite documentation (e.g., shareholder resolutions);

2) Establish the liquidation committee and file its registration;

3) Publish mandatory liquidation announcements;

4) Manage creditor communications and claims;

5) Verify and record declared debts;

6) Coordinate with CPA firms to: prepare debt and credit schedules, finalize asset inventories andbalance sheets, settle outstanding taxes, produce audit reports and advise on financial matters;

7) Secure tax clearance and de-register with tax authorityies; and

8) File deregistration documentats with Customs, AMR, social security authorities, housing provident funds and banking institutions.

The involvement of legal professionals in the company dissolution process delivers key advantages. First, legal counsels ensure full adherence to all applicable legal requirements throughout the liquidation process, mitigating risks of future legal disputes. Second, they facilitate communication with government authorities, ensuring efficient completion of critical procedures - such as tax clearance and deregistration - in full regulatory compliance. For example, a U.S. electronics firm exiting the Chinese market in late 2023 concluded its entire wind-down within four months through mutual agreements with over 90% of its employees and coordinated tax de-registration without post-dissolution litigation or any other disputes.

It should be noted that in the event of insolvency, the company is required to undergo the bankruptcy process, which falls outside this article’s scope.

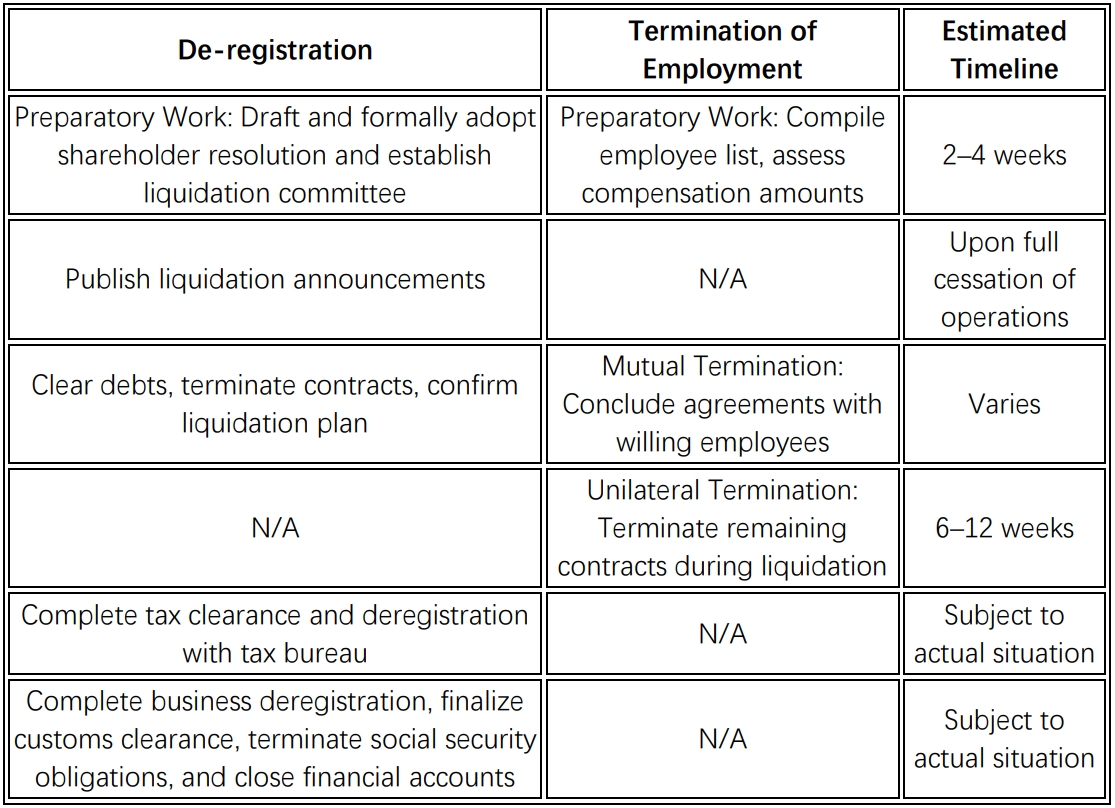

The table below outlines the corporate dissolution process, including employment termination and de-registration procesures. Parallel processing applies to tasks listed on the same row under the “De-registration” and “Termination of Employment” columns.

Concluding Remarks

Successfully terminating employment and lawfully closing a business in China demands thorough preparation and clear understanding of the applicable laws and regulations. Companies must fully discharge statutory obligations regarding employee severance and regulatory de-registration to avoid potential disputes, penalties, or reputational damage. With the support of experienced legal professionals, businesses can ensure a compliant and efficient exit process while mitigating liabilities.