Company Law: What Directors, Supervisors & Officers Need to Know

Company Law: What Directors, Supervisors & Officers Need to Know

On December 29, 2023, the Standing Committee of the National People’s Congress passed the Company Law of the People’s Republic of China (2023 Revision) (the “New Company Law”), which came into effect on July 1, 2024. The New Company Law has further clarified and strengthened the obligations and liabilities of directors, supervisors, and senior officers[1](each a “DSO”).

I.Duty of Loyalty

The previous Company Law of the People’s Republic of China (2018 Revision) (the “2018 Company Law”) only stipulates in broad principle that DSOs have duties of loyalty and diligence to the company, without further exploring what these duties are. The New Company Law fills this gap.

The New Company Law specifies that duty of loyalty means that DSOs must take measures to avoid conflicts between their personal interests and the company’s interests and may not exploit their power to seek improper benefits.

A. Prohibited Acts

While the 2018 Company Law only prohibits directors and senior officers from committing certain specified acts that breach their duty of loyalty, the New Company Law extends these prohibitions to supervisors as well. Under the New Company Law, such prohibited acts are as follows:

a.embezzling the company’s property or misappropriating the company’s funds;

b.depositing the company’s funds into accounts opened in their own names or in the names of other individuals;

c.exploiting their power to bribe or accept bribe or other illegal income;

d.accepting and possessing commissions for their own benefit from the transactions of the company with others;

e.disclosing the company’s confidential information without authorization; and

f.any other acts that breach their duty of loyalty to the company.

B. Conditionally Permitted Acts

a. Related Transactions

The 2018 Company Law places relatively fewer restrictions on related transactions conducted by a DSO with an unlisted company. Such transactions normally are not prohibited, provided that they do not breach the company’s articles of association. However, the New Company Law significantly strengthens restrictions on related transactions conducted by a DSO with his or her company.

Specifically, the New Company Law stipulates that when a DSO directly or indirectly enters into contracts or conduct transactions with his or her company, the DSO must (i) report relevant matters to the board of directors or the shareholders of the company, and (ii) obtain approval through a resolution adopted by the board of directors or shareholders in accordance with the company’s articles of association. Notably, the above requirements also apply to the transactions conducted by the following parties with the company: (i) close relatives[2] of DSOs, (ii) enterprises directly or indirectly controlled by DSOs or their close relatives, and (iii) individuals having other affiliation relationships[3] with DSOs.

In summary, compared with the 2018 Company Law, the main changes under the New Company Law regarding related transactions include: (i) subjecting supervisors to the regulations of related transactions governing directors and senior officers; (ii) mandating reporting of any transaction falling under the category of related transactions to the board of directors or shareholders and approval of such transaction by board resolution or shareholder resolution; and (iii) expanding the scope of related transactions to include transactions with enterprises directly or indirectly controlled by close relatives of DSOs, within the meaning ascribed to close relatives in regulations of related transactions.

b. Seeking Business Opportunities

Under the 2018 Company Law, without the approval of shareholders, no director or senior officer of a company may seek business opportunities that rightfully belong to the company. Under the New Company Law, DSOs (i.e., supervisors are also included) of a company may not leverage their position to seek for themselves or others business opportunities that rightfully belong to the company, unless any of the following conditions is satisfied: (i) the DSOs report the business opportunity to the board of directors or shareholders and obtain approval for pursuing the opportunity through a resolution adopted by the board of directors or shareholders in accordance with the company’s articles of association; or (ii) according to laws, administrative regulations, or the company’s articles of association, the company is unable to capitalize on such business opportunities.

In summary, compared with the 2018 Company Law, the main changes under the New Company Law regarding seeking business opportunities include: (i) subjecting supervisors to the regulations applicable to directors and senior officers; (ii) allowing the delegation of approval authority to the board of directors by stipulating the same in the company’s articles of association; and (iii) specifying the conditions under which DSOs can seek business opportunities.

c. Competition with the Company

“Competition” refers to engaging in business activities, either by oneself or on behalf of others, that are of the same kind as those conducted by the company where an individual holds a position.

Under the 2018 Company Law, without the approval of shareholders, directors and senior officers may not engage in any Competition with the company. Under the New Company Law, DSOs (i.e., supervisors are also included) may not conduct any Competition, unless they report the act of Competition to the board of directors or shareholders and obtain approval through a resolution adopted by the board of directors or shareholders in accordance with the company’s articles of association.

Compared with the 2018 Company Law, the main changes in the New Company Law regarding the Competition include: (i) subjecting supervisors to the regulation for Competition; and (ii) allowing the delegation of approval authority to the board of directors through the company’s articles of association.

d. Excluded Voting

“Excluded Voting” refers to the requirement that restricts a director with a conflict of interest in a matter to be resolved on by the board of directors (the “Director with Conflict of Interest”) from voting on such matter.

Under the 2018 Company Law, the Excluded Voting only applies to listed companies. However, the New Company Law expands this mechanism to cover all types of companies under certain circumstances. That is, for all types of companies, when the board of directors resolve on matters specified in the above items: a) related transactions, b) seeking business opportunities, and c) competition with the company, the Directors with Conflict of Interest are prohibited from voting, and their votes should be excluded from the total count. If the number of directors other than the Directors with Conflict of Interest attending the board meeting is less than three, the matter to be resolved on must be submitted to the shareholders’ meeting for a decision.

II.Duty of Diligence

The New Company Law clarifies that the duty of diligence requires DSOs to exercise the reasonable care that managers ordinarily exercise, acting in the best interest of the company while performing their duties.

DSOs’ duty of diligence is demonstrated through their obligations to maintain the company’s capital adequacy. The capital system is one of the key reforms in this revision of the Company Law. To balance the rights and obligations among relevant parties, the New Company Law not only imposes more stringent requirements on shareholders, but also enhances the obligations and liabilities of DSOs in maintaining the company’s capital adequacy. For example, the New Company Law stipulates DSOs’ obligations to demand capital contributions, prevent shareholders from withdrawing capital contributions, and avert unlawful distributions and illegal reductions in registered capital. It further stipulates that DSOs who fail to perform the above obligations are held liable to the company. In this way, DSOs become the key safeguards placed between the company and shareholders, preventing potential illegal capital outflows and thereby better protecting the interests of the company and its creditors.

A. Verifying and Demanding Shareholders’ Capital Contributions (For Directors Only)

Under the New Company Law, the board of directors of a company must verify the capital contributions made by shareholders. If it is found that any shareholder has not made its capital contribution in full within the period specified in the company’s articles of association, the company must demand such payment in writing. If directors fail to fulfill the foregoing obligation in a timely manner, causing losses to the company, such directors shall be held liable for the losses.

This requirement only applies to directors and does not extend to supervisors or senior officers. If a director finds that a shareholder has not made the required contributions, the director must report to the board of directors. The board of directors will then decide on an appropriate grace period and collection plan, and submit a request to the company, suggesting the company issue a written demand letter to the shareholder for payment. To prevent potential negligence or oversight, the board of directors may also consider incorporating the verification of shareholders’ capital contributions as a recurring item on the agenda for periodic review.

B. Preventing Shareholders from Withdrawing Capital Contributions

Withdrawing capital contributions refers to an improper withdrawal of capital that a shareholder has already contributed, such as manipulating financial statements to exaggerate profits for distribution, transferring capital through fictitious business dealings, or exploiting related transactions to transfer capital.

The New Company Law stipulates that if a shareholder withdraws its capital contribution in a noncompliant way, which causes losses to the company, the DSOs must bear joint and several liabilities with that shareholder for the losses.

C. Preventing Illegal Profit Distribution

Before a company distributes after-tax profits to shareholders, it must go through the following procedures: (a) making up losses, (b) allocating funds to statutory reserves, (c) allocating funds to discretionary reserves (if approved by shareholder resolutions); and (d) obtaining approval for distribution of the remaining profits through shareholder resolutions. The distribution must be implemented by the board of directors within six months upon adoption of such shareholder resolutions.

The New Company Law stipulates that if a company distributes profits to shareholders in violation of laws, such as distributing profits without making up losses before distribution of profits, the shareholders must return the improperly distributed profits to the company. If the company suffered losses therefrom, the shareholders and the DSOs must bear liabilities for the losses.

D. Preventing Illegal Capital Reduction

A company must meet certain conditions and follow specific procedures when reducing its registered capital, including but not limited to: (a) adopting a shareholder resolution with regard to reducing the registered capital, with not less than two-thirds of the voting rights in favor, and subsequently amending the company’s articles of association accordingly; (b) preparing the balance sheet and asset list; (c) notifying creditors and making public announcement; (d) paying off debts or providing appropriate guarantees; and (e) updating the capital registration with the corporate registration authority.

The New Company Law stipulates that if a company reduces its registered capital in violation of laws, shareholders must return the funds they received, and if in the case of such noncompliant capital reduction, shareholders are granted exemption from or a reduction in capital contributions, their original obligation of contribution must be reinstated. If the company suffered losses therefrom, the shareholders and the DSOs must bear liabilities for the losses.

III.Other Obligations

A. Obligation Upon Liquidation (For Directors Only)

a. Directors as Liquidation Obligors

Under the 2018 Company Law, a company is required to establish a liquidation committee within a specified period after any dissolution event occurs. However, there is no further provision on designating the party responsible for forming the liquidation committee. The New Company Law introduces the concept of “Liquidation Obligor”, appointed from among directors and is obliged to form the liquidation committee within a specified period upon the occurrence of any dissolution event. If the Liquidation Obligors fail to fulfill their liquidation duties in a timely manner, causing losses to the company or creditors, they must assume liabilities for the losses.

b.Directors Deemed as Liquidation Committee Members by Default

Under the 2018 Company Law, for a limited liability company, shareholders are members of the liquidation committee. However, under the New Company Law, by default, directors are members of the liquidation committee, unless otherwise stipulated by the company’s articles of association or decided by shareholder resolutions. Members of the liquidation committee have duties of loyalty and diligence. If they fail to perform their liquidation duties and cause losses to the company, they are held liable for the losses. If, due to their intentional acts or gross negligence, creditors suffer losses, they are also liable for the losses.

B. Duty to Diligently Perform Duties

The New Company Law stipulates that if DSOs violate laws, administrative regulations, or the company’s articles of association in the performance of their duties, causing losses to the company, they should indemnify the company against such losses.

Additionally, if directors or senior officers cause harm to entities other than the company in the course of performing their duties, the company should be held liable for compensation. If directors or senior officers act with malicious intent or gross negligence, they should also be held liable for compensation.

C. Directors’ Liability Insurance (For Directors Only)

The New Company Law stipulates that a company may purchase and maintain liability insurance for its directors during their term of office, against civil liabilities arising from their performance of company duties. After the company has purchased or renewed such liability insurance for directors, the board of directors should report to shareholders details of the insurance, including the coverage limit, scope of coverage, and insurance premium rates.

D. Duty to Refrain from Actions Detrimental to the Company or Shareholders’ Interests (For Directors and Senior officers Only)

In addition to seeking improper benefits for themselves (which violates the duty of loyalty), directors and senior officers may also be instructed by the company’s controlling shareholders[4] or actual controllers[5] to engage in activities that harm the interests of the company or its shareholders. The New Company Law specifies that under the above circumstances, directors and senior officers must be held jointly and severally liable with the company’s controlling shareholders or actual controllers.

Moreover, regardless of the intent, if directors or senior officers violate laws, administrative regulations, or the company’s articles of association in a way that harms shareholders’ interests, shareholders have the right to file a lawsuit against them.

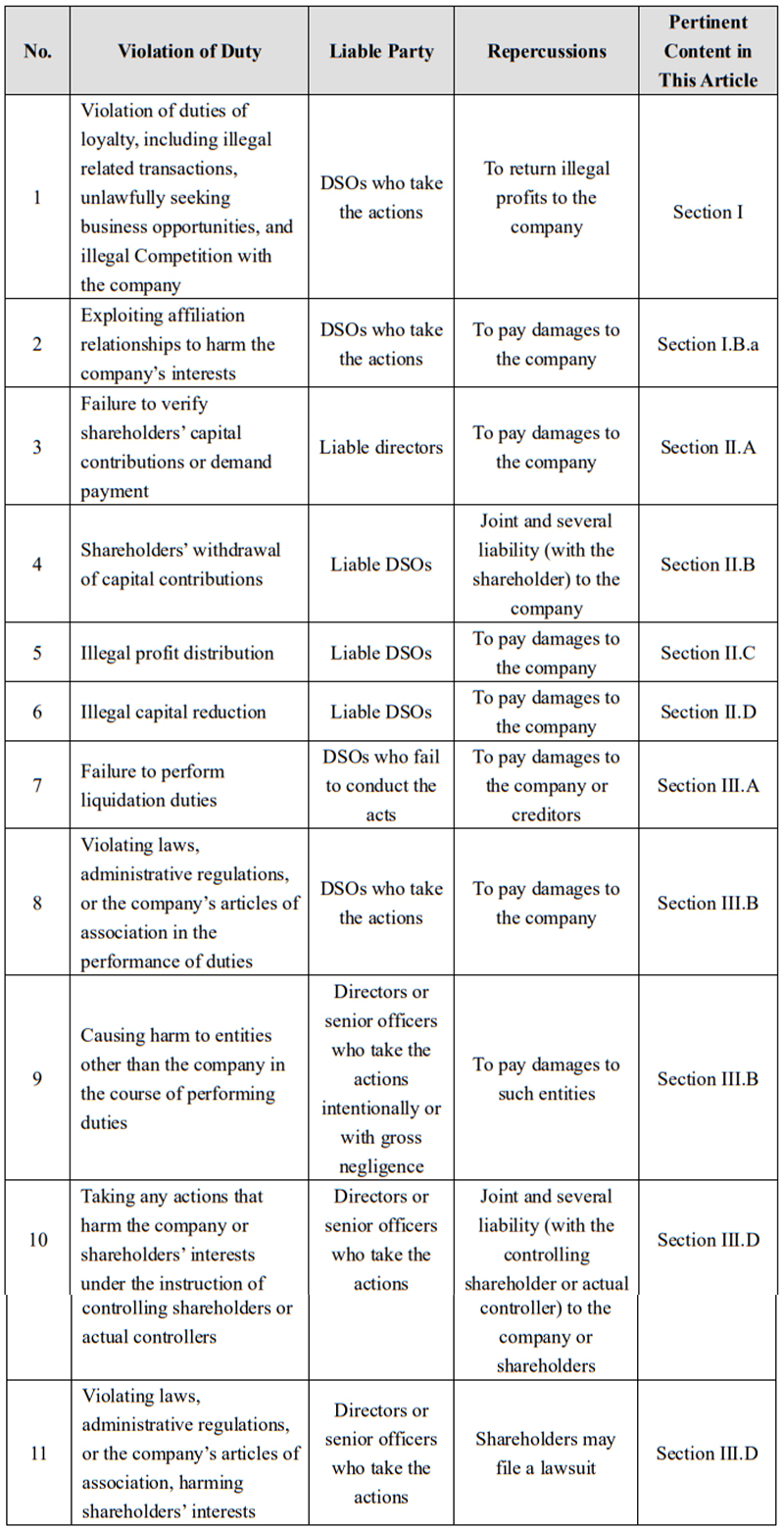

IV.Liabilities for Violating the Duties of DSOs

A. Civil Liabilities Under the New Company Law

DSOs who violate their duties under the New Company Law may face consequences such as returning illegal earnings, paying damages, and responding to lawsuits. The details are as follows:

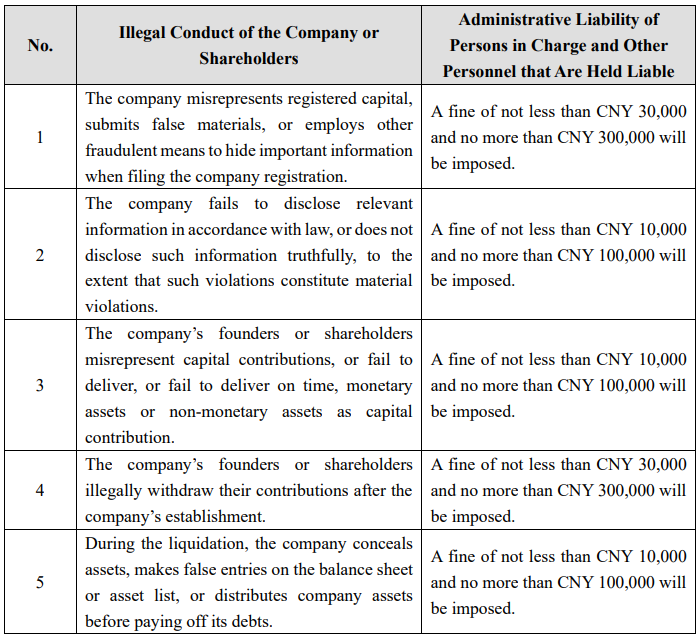

B. Administrative Liabilities under the New Company Law

When the company or shareholders engage in illegal activities and are required to bear corresponding administrative liability, “persons in charge and other personnel that are held liable” may also face corresponding administrative penalties in addition to civil liabilities. Although the New Company Law does not explicitly stipulate the administrative liability of DSOs, since directors and senior officers play key roles in a company’s operation, and supervisors constitute the internal supervisory body of a company, they could potentially categorized as “persons in charge and other personnel that are held liable”. The details are as follows:

C. Criminal Liabilities

In addition to civil and administrative liabilities, DSOs should also be aware of risks of criminal penalties for violating their obligations under the New Company Law. On December 29, 2023, the same day when the New Company Law was passed, Amendment XII to the Criminal Law (“Amendment XII”) was also passed. Amendment XII, which came into effect on March 1, 2024, has amended three clauses pertaining to crimes for the breach of fiduciary duties, i.e., crimes of “illegal operation of competing business”, “illegally seeking profits for relatives and friends”, and “abusing power to sell company assets at low prices”.

Prior to the promulgation of Amendment XII, only state-owned enterprises might be held liable for these three crimes, but the scope is now expanded to encompass all companies. These crimes specifically address cases of engaging in competing business activities, illegally seeking profits for friends or relatives from the company where he/she holds a position, and abusing power to sell company assets at low prices. In cases of serious violations, relevant individuals (including DSOs) may face criminal penalties, with a potential sentence of up to seven years.

V.Suggestions

The New Company Law has strengthened the obligations and liabilities of DSOs, and the DSOs’ duties (e.g., duty of loyalty, and duty of diligence, etc.) have impact on the companies they serve during their entire lifecycles, from establishment to dissolution. To facilitate enforcement of the more stringent obligations and liabilities, the New Company Law also for the first time recognizes director liability insurance policies, recommending that companies may purchase and maintain liability insurance for directors during their term of office. To assist DSOs in addressing the risks under the New Company Law, we suggest as follows:

A. Focusing on Performance of Duties and Enhancing Awareness of Liability

DSOs should actively engage in the company management and supervision in line with their respective remits and fulfill their duties in a responsible manner. They should familiarize themselves with the company’s operations, remain actively involved in corporate matters, and ensure full participation in relevant decision-making and management activities.

B. Focusing on Independence in Performing Duties and Following Internal Procedures

DSOs should pay special attention to related transactions and Competition with the company, and ensure that such matters are reported to the board of directors or shareholders, and are approved in advance by board resolutions or shareholder resolutions in accordance with the company’s articles of association. At the same time, DSOs should make decisions and grant approvals by strictly following the company’s established procedures to guarantee the legality and compliance of all decisions and operations.

C. Meeting Minutes Are Important

It is advisable to ensure that all meeting minutes are detailed and accurate to facilitate tracking of decision-making processes and outcomes and serve as a basis for audits and legal reviews. Directors should be responsible for the board resolutions in which they participate. If a board resolution violates laws, administrative regulations, the company’s articles of association, or shareholder resolutions, and causes significant losses to the company as a result, the directors involved in that resolution are liable for indemnifying the company against such losses. However, if a director expresses dissent during voting, and such dissent is formally recorded in the meeting minutes, the director may be exempted from liabilities arising from the resolution to which such dissent is related.

D. Regular Training Programs

Companies are advised to organize regular training with respect to the DSOs’ duties and potential risks faced by DSOs. The training may focus on providing guidance to DSOs for performing their duties.

E. Obtaining Liability Insurance for DSOs

Companies may consider purchasing liability insurance for DSOs. For companies that have already purchased such insurance, they may expand the insurance’s scope of coverage in light of the strengthened obligations and liabilities of DSOs under the New Company Law.

F. Focusing on Liabilities Beyond the New Company Law

The New Company Law is designed to protect the legitimate rights and interests of companies, shareholders, employees, creditors, and other stakeholders. Therefore, it primarily outlines DSOs’ liabilities regarding the organization and operation of companies. However, the scope of their liabilities extends beyond the boundaries established by the New Company Law.

For example, during DSOs’ performance of their duties, they may also face other compliance issues, such as cybersecurity and data protection, environmental protection, safety production, land use compliance, bidding and procurement, anti-corruption, anti-monopoly, etc. These compliance matters are regulated by specific laws and regulations in addition to the New Company Law.

Taking cybersecurity and data protection as an example, on July 21, 2022, the Cyberspace Administration of China imposed a fine of CNY 8.026 billion on Didi Global Inc., in accordance with the PRC Cybersecurity Law, the PRC Data Security Law, the PRC Personal Information Protection Law, the PRC Administrative Penalty Law, and other relevant regulations. Additionally, the company’s chairman and CEO, and president were held liable and each fined CNY 1 million.

[Note]

[1] “Senior officer” refers to a company’s manager, deputy manager, or financial officer, the board secretary of a listed company, or any other personnel specified as a senior officer in a company’s articles of association.

[2] “Close relatives” refers to spouses, parents, children, siblings, grandparents, and grandchildren.

[3] “Affiliation relationship” refers to the relationship between the DSOs and the enterprises they directly or indirectly control, and other relationships that may lead to the compromise of the company’s interests. However, the enterprises controlled by the government may not be regarded as having related relationship for the sole reason that they are commonly controlled by the government.

[4] “Controlling shareholder” refers to (a) a shareholder whose capital contribution accounts for more than 50% of the total registered capital of a limited liability company, or whose shares account for more than 50% of the total shares of a company limited by shares, or (b) a shareholder whose capital contribution or shares held by it are less than 50%, but whose voting rights according to its capital contribution or the shares held by it have a significant impact on the shareholder resolutions.

[5] “Actual controller” refers to anyone who is able to actually direct the company by means of investment relations, agreements, or any other arrangements.